High Deductible Health Plans (HDHPs) – Market Changes and Growth Since the Passage of the ACA

This article provides an overview of HDHP/HSA plans, how the ACA modified regulation of HDHP/HSA plans, and market trends relating to self-insured employer use of HDHP/HSA plans.

Download a brochure of this article here.

Overview of HDHP/HSA Plans

There are two key features of a high deductible health plan: 1) a high deductible that must be met before the health plan covers most1 services and 2) a tax-exempt health savings account that the covered individual contributes money to in order to pay the high deductible and other forms of cost-sharing.

A HDHP/HSA plan is an alternative to traditional health insurance; it is a savings product that offers a different way to pay for health care. HSAs enable employees to pay for current health expenses and save for future qualified medical and retiree health expenses on a tax-free basis.

An employee must be covered by a High Deductible Health Plan (HDHP), meaning in 2015 the employee must pay a deductible of $1,300 for self-only and $2,600 for family2 coverage before receiving health plan coverage for non-preventive services, to be able to use an HSA. An HDHP generally costs less than what traditional health care coverage costs; the money saved can be put into the HSA.

An employee owns and controls the money in the HSA. Decisions on how to spend the money are made by the employee without relying on a third party or a health insurer. The employee will also decide what types of investments to make with the money in the account in order to make it grow.

Benefits of a HSA

There can be several benefits to HSAs.3

- An employee can claim a tax deduction for contributions made to the HSA even if the employee does not itemize deductions on Form 1040.

- Contributions to an HSA made by the employer (including contributions made through a cafeteria plan) may be excluded from the employee's gross income.

- The contributions remain in the employee's account from year to year until they are used.

- The interest or other earnings on the assets in the account are tax free.

- Distributions may be tax free if the employee paid qualified medical expenses.

- An HSA is “portable”; it stays with the employee if he or she changes employers or leaves the work force.

Changes to Tax-Favored Accounts under the Affordable Care Act

Distributions for Medicine Qualify Only if for Prescribed Drug or Insulin

Under the Affordable Care Act (ACA), reimbursements from HSAs qualify only if made for a medicine or drug that is a prescribed drug, or insulin, and specifically excludes over-the-counter drugs that were previously included. Over-the-counter medicine obtained with a prescription will continue as a qualified medical expense.

Tax Increase on Nonqualified Medical Expense Distributions from HSAs

The ACA increases the excise tax, to 20 percent, on distributions from a HSA or Archer Medical Savings Account (MSA) if the distributions are not for a qualified medical expense (including over-the-counter medicines and drugs purchased without a prescription).

New Threshold in 2013 to Itemize Medical Expenses as Deduction

Under the ACA, the threshold to itemize unreimbursed medical expenses as a deduction on tax returns increased in 2013 from 7.5 percent to 10 percent of adjusted gross income (AGI). Note: There is a temporary exemption from January 1, 2013 to December 31, 2016 for individuals age 65 and older and their spouses. The threshold remains at 7.5 percent of AGI for those taxpayers until December 31, 2016.4

Application of Annual Dollar Limit Prohibition to HSAs

Interim final rules issued by the Departments of Treasury, Labor, and Health and Human Services clarify that the ACA’s annual limit rules do not apply to HSAs or MSAs.5

Growth in HDHP/HSA Plans

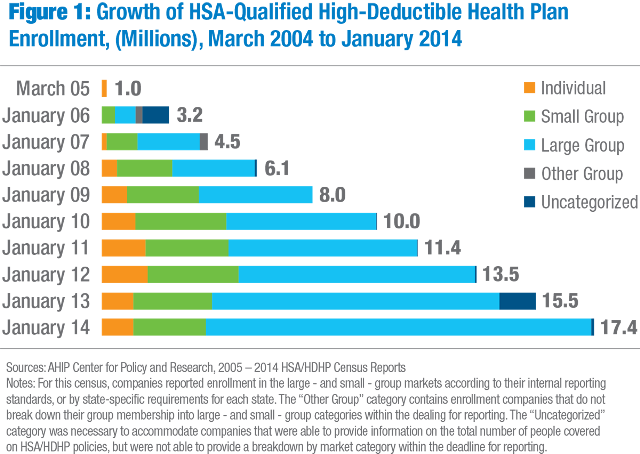

Enrollment in HSA-eligible plans has grown significantly over the years. As of January 2014, nearly 17.4 million individuals were covered by HSA-eligible plans, which represents an increase of almost 12 percent (or approximately two million enrollees) from 2013.6

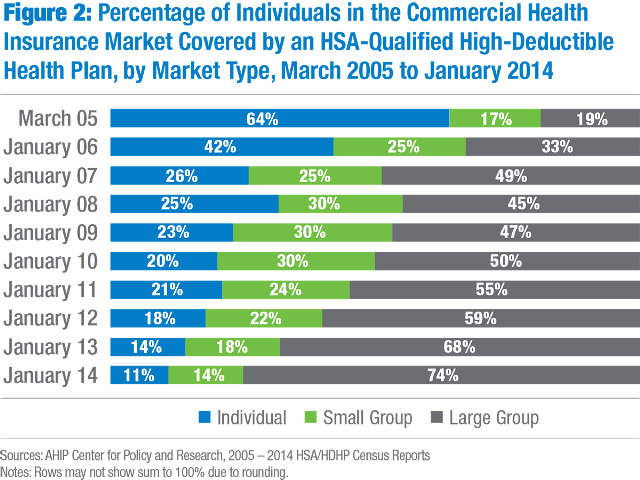

The recent growth in HSAs has come mostly from the large group market (including fully insured and self-insured employers), which we expect to continue, given the increasing enrollment in HDHPs. In January 2014, 74 percent of those enrolled in an HSA-qualified HDHP were in the large group market.7

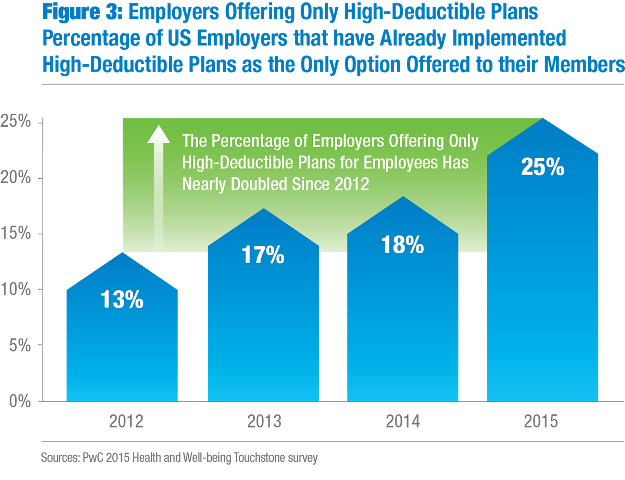

While some large employers have shifted to private exchanges, many large employers will continue with self-insured plans for two main reasons: 1) to have more control over the offerings to employees and 2) to avoid the sales tax on fully insured health plan premiums. However, employers are still shifting to HDHP/HSA plans. According to research from PwC, employers offering HDHPs grew almost 300 percent since 2009.8 In 2012, 13 percent of employers took this route, 17 percent in 2013, 18 percent in 2014, and 25 percent in 2015.9 Additionally, 81 percent of large employers surveyed by the National Business Group on Health said they would offer at least one consumer-directed health plan in 2015, up from 72 percent in 2014.

Download a brochure of this article here.

Article Provided Courtesy of ADVI

Valerie Reynolds, Director

valerie.reynolds@advi.com

Krista Lambo, Manager

krista.lambo@advi.com

Sources:

- A health plan will not fail to qualify as an HDHP merely because it provides certain preventive health services without a deductible; as described in this IRS guidance http://www.irs.gov/pub/irs-drop/n-13-57.pdf Internal Revenue Service. 26 CFR 601.602: Tax forms and instructions. Rev. Proc. 2015-30. Accessed online: http://www.irs.gov/pub/irs-drop/rp-15-30.pdf.

- Internal Revenue Service. Publication 969. Accessed online: http://www.irs.gov/publications/p969/ar02.html#en_US_2012_publink1000204025.

- Internal Revenue Service. Publication 969. Accessed online: http://www.irs.gov/publications/p969/ar02.html#en_US_2012_publink1000204025.

- Internal Revenue Service. Changes to Itemized Deduction for 2014 Medical Expenses. Accessed online: http://www.irs.gov/Individuals/2013-Changes-to-Itemized-Deduction-for-Medical-Expenses.

- 75 Fed. Reg. 37188. Accessed online: http://www.gpo.gov/fdsys/pkg/FR-2010-06-28/pdf/2010-15278.pdf.

- AHIP Center for Policy and Research. July 2014 report: January 2014 Census Shows 17.4 Million Enrollees in Health Savings Account – Eligible High Deductible Health Plans (HSA/HDHPs). Accessed online: https://www.ahip.org/Press-Room/2014/HSA-Census-Survey/.

- AHIP Center for Policy and Research. July 2014 report: January 2014 Census Shows 17.4 Million Enrollees in Health Savings Account – Eligible High Deductible Health Plans (HSA/HDHPs). Accessed online: https://www.ahip.org/Press-Room/2014/HSA-Census-Survey/.

- PwC. Health Research Institute. June 2015 Report - Medical Cost Trend: Behind the Numbers 2016.

- Ibid.