Generic Inflation Part 1: What’s Behind Higher Generic Prices?

This edition of MedConnect explores many of the drivers behind the generic price inflation phenomenon. A subsequent edition will discuss solutions that MedImpact delivers to help payors mitigate the impact of this inflationary trend.

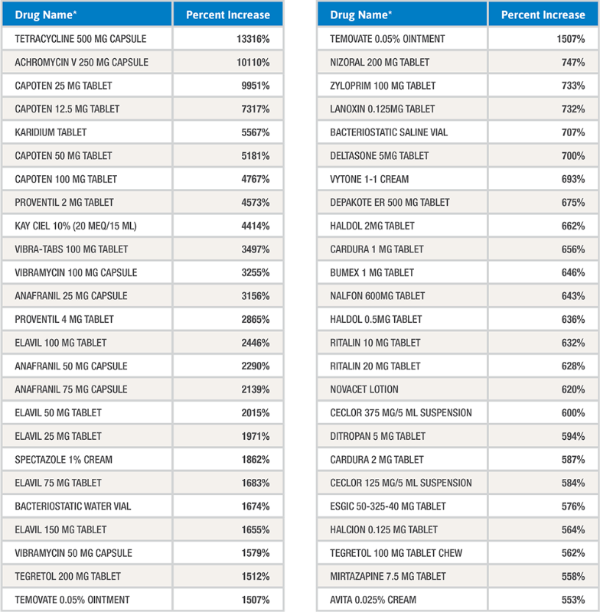

The table below contains a number of products that have experienced significant price increases in the past year. As a commodity market, generic prices are typically deflationary. Why is that not occurring on products like those listed below?

Reasons for this pricing phenomenon include the basic economic principle of supply and demand, as well as business economics and profitability motives.

Six of the most influential factors driving these price increases are:

1. Increasing FDA Backlog

Though generic usage has been growing, the approval process for generics has become slower over time. While several factors can influence slower approvals (an increase in generic drug applications, more complex brands, etc.), a key factor has been a resource-constrained FDA’s Office of Generic Drugs. The backlog of Abbreviated New Drug Applications (ANDAs) pending approval has steadily increased over time; the median ANDA approval time stands at around 42 months. There are roughly 4,000 ANDAs pending at the FDA.2. Manufacturer Consolidation

Mergers and acquisitions in the generic manufacturing industry have reduced the number of suppliers of generic drugs. When there are fewer suppliers, the market transforms into an oligopoly, and as a result, the commodity pricing dynamics normally seen in the generic market disappear. With fewer competitors in the market, manufacturers begin to increase pricing for their products.The U.S. generic industry remains fragmented and additional consolidation is likely. There already have been 11 major deals in 2015, which follows 18 in 2014 and 14 in 2013.

Additionally, Wall Street analysts have identified 58 potential takeover targets with sales between $100 million and $1 billion (of these, 32 are privately held companies).

A secondary influence associated with industry consolidation is greater price volatility in cases of supply or production disruption. With fewer manufacturers able to meet demand, disruption of one or two large suppliers can lead to critical shortages and rapid inflation.

3. Raw Material Supply Disruptions

Many generic manufacturers purchase ingredients contained in their products from other entities. When those entities experience production disruptions due to capacity problems, unexpected demand, regulatory issues, and even political instability, they may be unable to supply the demand for raw materials. The inability to obtain ingredients has led to supply issues in the generic market, with consequential shortages and price increases on the finished products.4. Increased FDA Scrutiny and Controls

Several companies appear to be feeling the effects of a more stringent FDA environment surrounding Good Manufacturing Practices (GMPs). The agency’s actions are affecting companies of all types (large and small, domestic and foreign, and generic and brand). The FDA has increased their scrutiny of generic drug GMPs, especially overseas in countries such as India and China, resulting in the shutdown of plants producing U.S.-bound generics and raw materials. During the recent past, the FDA closed four plants operated by Ranbaxy, one of the world’s largest producers of generics. The loss of this manufacturing capacity results in less supply and higher prices for those affected generic products.5. Portfolio Optimization

Many generic manufacturers have abandoned certain product lines in order to use their production facilities to make generics with greater profitability. Two main conditions are associated with this optimization:- Complex and High Production Costs - Some manufacturers, such as those producing the ophthalmic, topical and other specialized formulations have stopped manufacturing those products due to high costs in manufacturing overhead and lower ROI.

- Highly Competitive Markets - Some manufacturers have abandoned the marketing of certain products due to a high number of competitors and aggressive pricing, making the product insufficiently profitable. As an example, the introduction of a generic for Celebrex® saw only half of the approved ANDA manufacturers come to market upon launch, primarily due to a concern over the high number of competitors and the impact on price and profit. Not only did the appearance of fewer manufacturers in the market create a higher priced environment simply based on less competition, but those manufacturers had underestimated their initial production demand and were unable to adequately supply the market, resulting in market shortages of the generic product and further stimulated higher pricing.

6. Authorized Generics

An authorized generic (AG) is simply a brand product in a generic package, where a brand company (innovator) for one reason or another “authorizes” a generic company to market its product as a generic. The innovator does not need to get a separate ANDA approved as its drug is already approved as an NDA. Authorized generic launches often occur during another generic company’s six-month exclusivity period, which reduces the sales and profits available to this “true” generic player.From the innovator’s perspective, striking authorized generic deals can accomplish several goals, which may include:

- Settling litigation

- Enhancing profits by participating in the generic market

- Addressing manufacturing capacity issues

- “Sending a message” to generic companies with the goal of reducing profits available to generics

We continue to assume that most new generic product launches will include an AG player.

A subsequent issue of MedConnect will discuss ways in which MedImpact can help our clients stay ahead of theses generic market dynamics and proactively mitigate the risks associated with generic price inflation.

Jim Ayers, R.Ph. BS Pharm.Director, Generic Strategies

Howard Wild, R.Ph. BS Pharm.

Vice President, Generic Strategies